Use-case developers

Use-case developers are any issuers who want to leverage Redbelly’s infrastructure to tokenise real-world assets. The target archetype for Redbelly’s commercial outreach were those who met the following criteria:

- Open to or need a blockchain

- Deal in high value assets within a regulated class

- Have an unaddressed, or unsuccessfully addressed need

- Opportunity to increase capital efficiency

- Have influence over delivery within value chain

- Can support parallel technology

- Are focused on new value creation

Discovering needs

Based on the target criteria, I conducted a research initiative with the following objectives:

- De-risk the desirability hypothesis that posited asset issuers in licensed markets were seeking to increase the liquidity of their assets via tokenisation.

- Gain insight into the expectations they have of any infrastructure they’ll choose to employ.

Knowing that the market for real-world asset tokenisation is immature and therefore, definitive—or quantitatively backed—answers to some questions would not not exist, the research sought to gain insight from reviewing existing studies and thought leadership, as well as, talking directly to key stakeholders within applicable financial organisations. The research methodology thus brokedown like so:

- Market research: Reviewing applicable public reports and case studies.

- Qual study: Interviewing five decision-making asset issuers/market service providers.

Collage of some of some studies reviewed and interviews conducted.

Collage of some of some studies reviewed and interviews conducted.

Discovery insights and takeaways

The research validated the position of Redbelly as an infrustrature specifically intended to tokenise real-world assets, and that real-world asset tokenisation was indeed being pursued.

Demand for tokens

According to the EY study, Driving meaningful opportunity: tokenisation in asset management, investors plan to allocate as much as 9% of their portfolios to tokenised assets by 2027, particularly Real-estate and private equity because it increases:

- Diversification: Access to new investments

- Decision to execution speed: Exit positions much quicker to reduce risk on the balance sheet

Demand to tokenise

Asset issuers are faced with rising operational costs in the current model, making it hard to stay competitive whilst under pressure to provide value to investors.

- Automation provided by programmable smart-contracts

- Transparency of a single source of truth inherent to blockchain networks

- Increased liquidity potential offered by fractionalisation and secondary trading

- Risk mitigation achieved by making assets more accessible, tradable, and secure

- Reduced settlement risk through near-instant transaction speed

Issuers are beginning to tokenise

Assets issuers are taking steps to tokenise a range of financial instruments, including:

- Cash / Cash products

- Company stock

- Bonds

- Environmental credits

How early adopters are proceeding

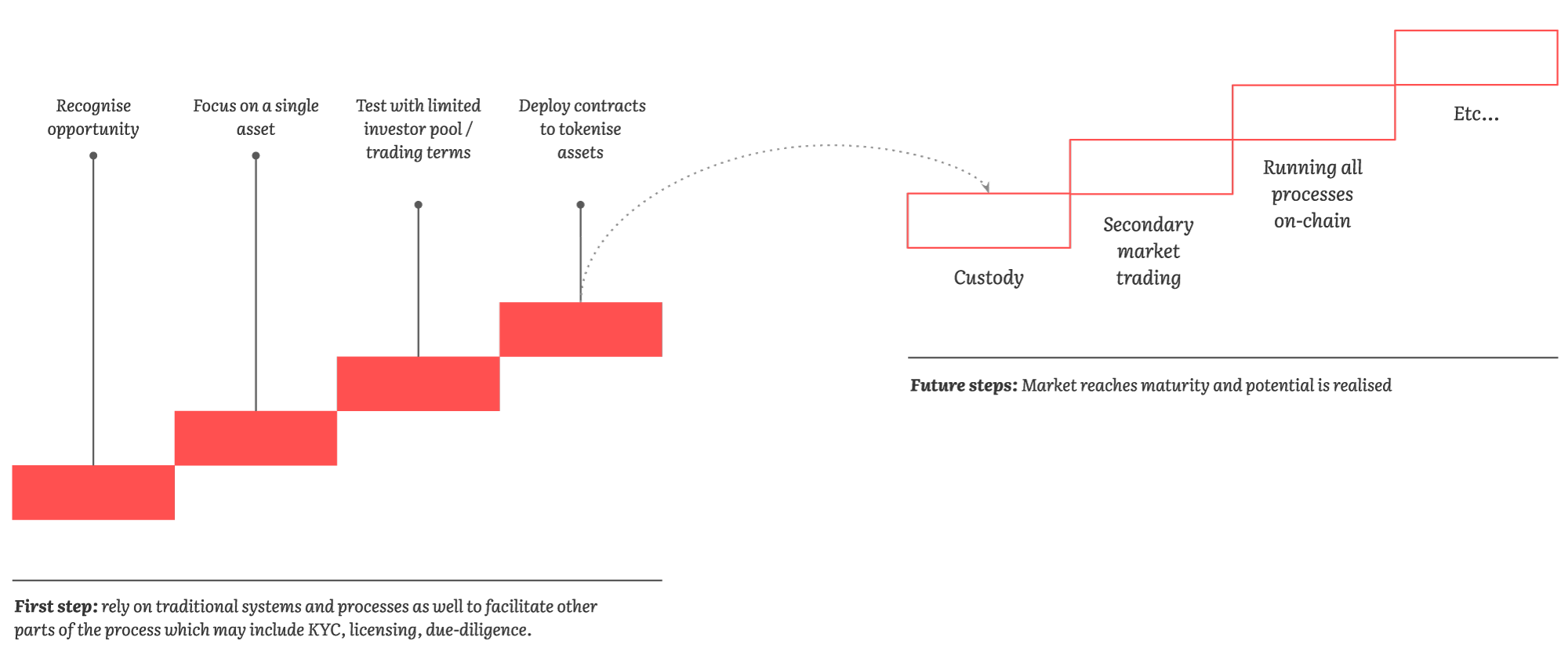

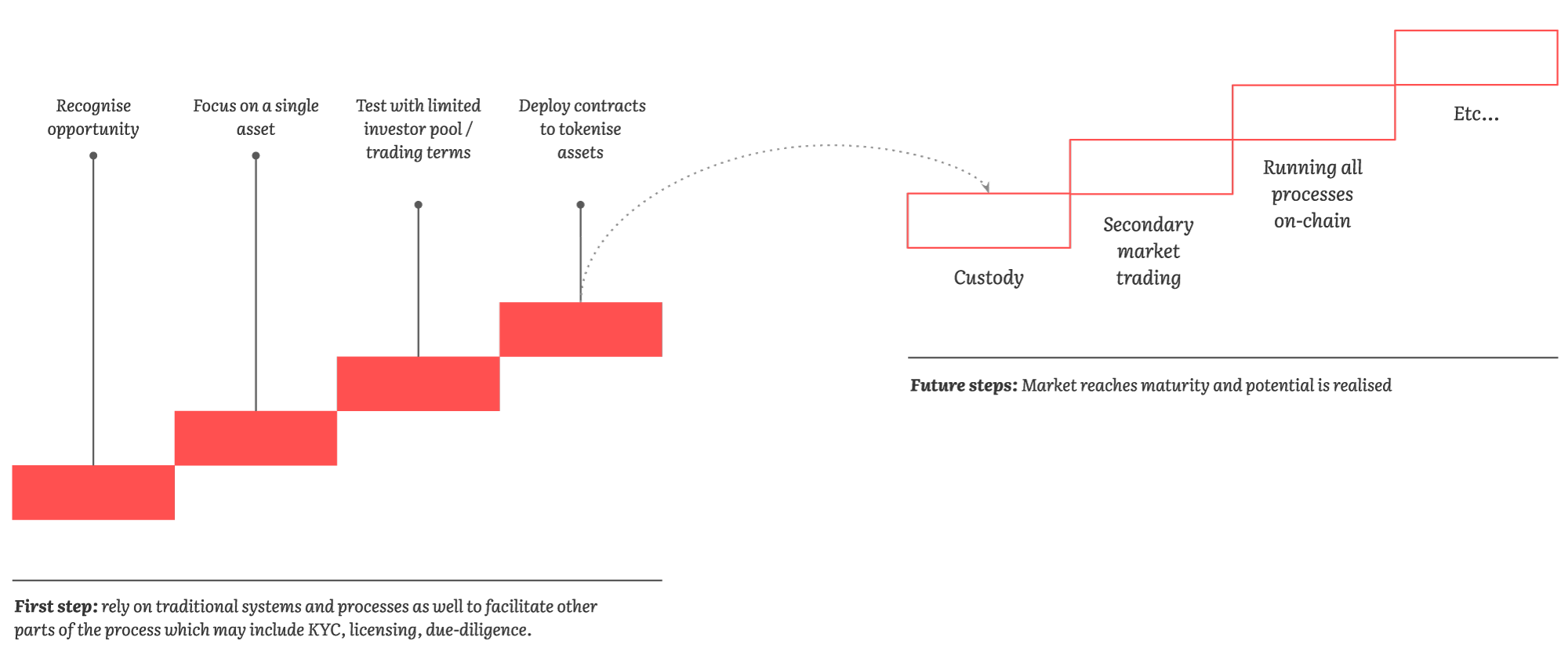

Through the interviews it was discovered that asset issuers are taking pragmatic steps to being the tokenisation process, focusing on a small number of assets types, limiting customers and keeping the compliance operations off-chain. Once proven, they can expand their tokenisation offering.

Steps being taken in the short term vs longer-term for asset tokenisation issuers.

Steps being taken in the short term vs longer-term for asset tokenisation issuers.

Barriers

Friction toward tokensition broke down in three ways: technical barriers, regulatory uncertainty, and eco-system challenges.

Tech barriers

Tokenisation platforms must immidiatley meet Traditional Finance (TradFi) expectations to unblock feasability such as processing fees on popular blockchains, “There is that hidden cost that will continue to be an issue and if some of the other chains get more exposure it will be nicer. Gas and speed, we can do a Stellar or XRP transaction in seconds, but not on Ethereum, it takes many minutes.”. Going forward, however, more standardisation will be sought to unlock interopability.

Regulatory uncertainty

Players familiar with Traditional Finance (TradFi) compliance obligations are becoming more and more comfortable with the application of existing frameworks and policies to tokenised assets, saying, “We've already gone past what they are saying they're going to put in place... we're quite comfortable, and so are our lawyers.”

Eco-system challenges

Less risk-averse early adopters can help change hearts and minds because their remains a negative connotation around “blockchain” and “crypto”. According to a SIX study, Cornerstones for Growth, there is also a lack of investor confidence because they don't believe they’ll be afforded the protections they receive from traditional markets. One interviewee noting the role of smaller institutions to led the way, “Private players can be more agile in this space, the banks will not take something institutional, or public, because their risk departments will not take that risk.”

Recommendations

Given Asset issuers WANT to tokenise, and be compliant with regulators, a solution which offers them the infrastructure is worth pursuing. In the immediate, Redbelly can support early adopters to overcoming tech barriers by raising awareness and providing guidance to such use-case developers on leveraging Redbelly’s infrastructure to meet operational needs around:

- Throughput: Transaction workloads

- Finality: Quasi-instantaneous transaction settlement

- Security: immutability needs

Designing the journey

Guiding use-case developers on leveraging the technology

Based on the outcome of the research, it was clear that making it as easy as possible for early adopters to leverage Redbelly’s infrastructure in order to tokenise assets was the priority. With that in mind, the focus went on providing use-case developers with an experience to successfully meet their objectives.

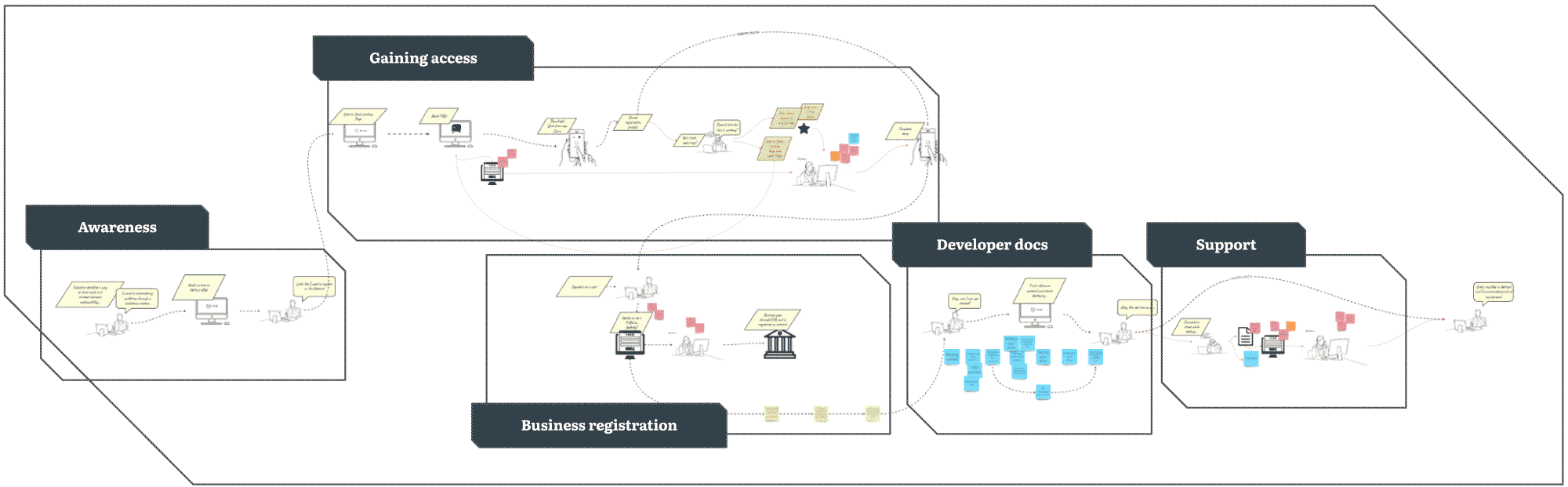

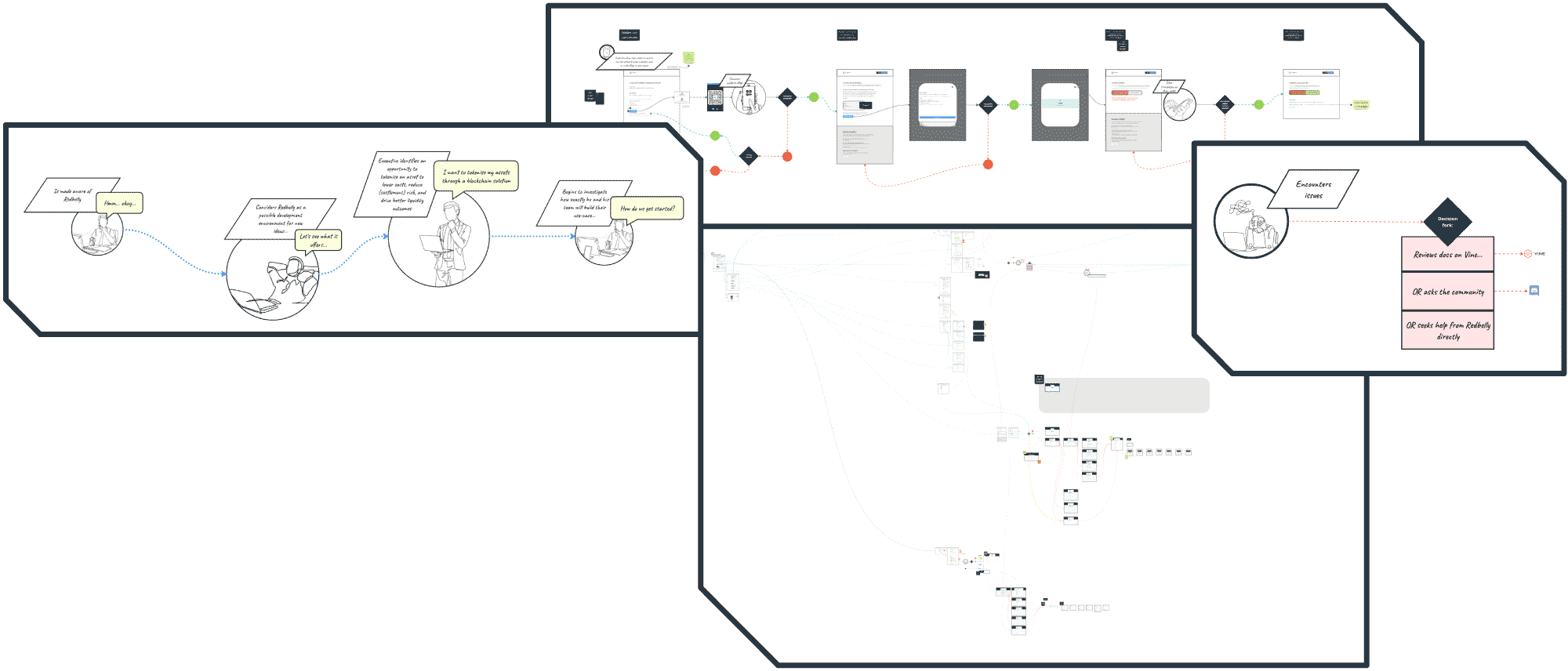

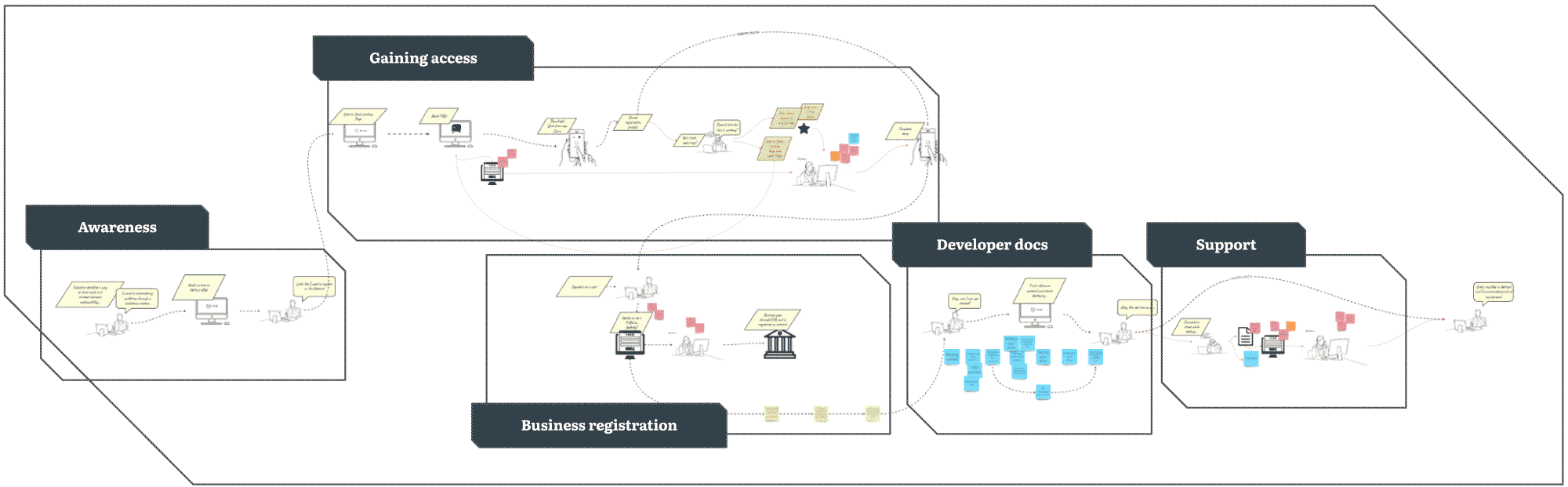

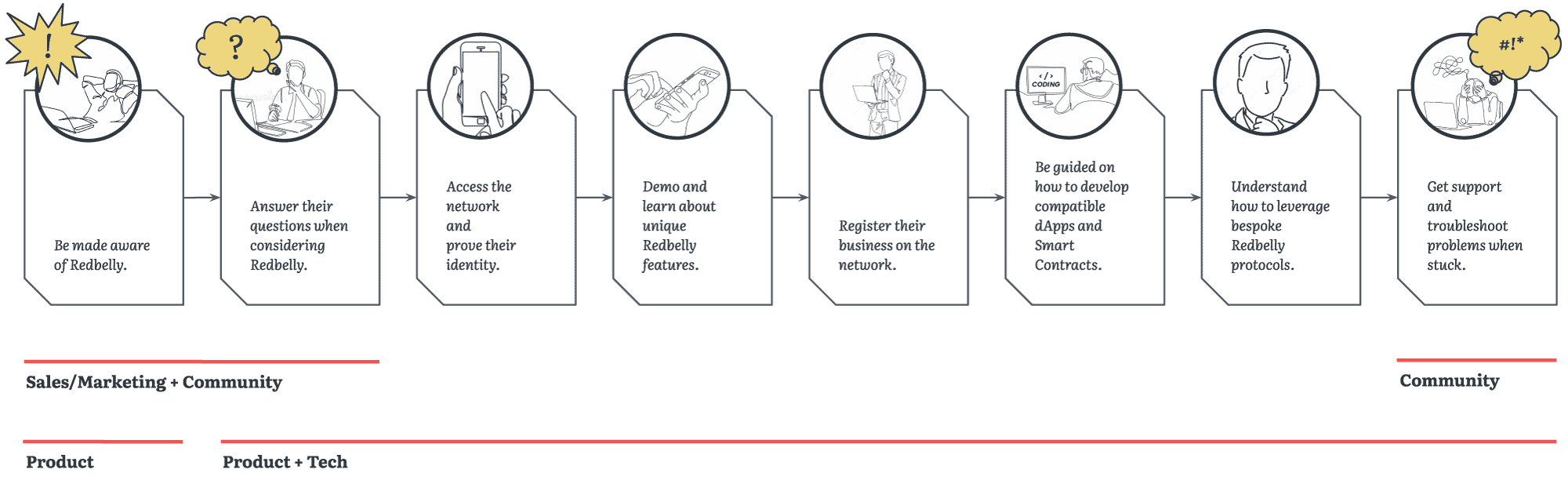

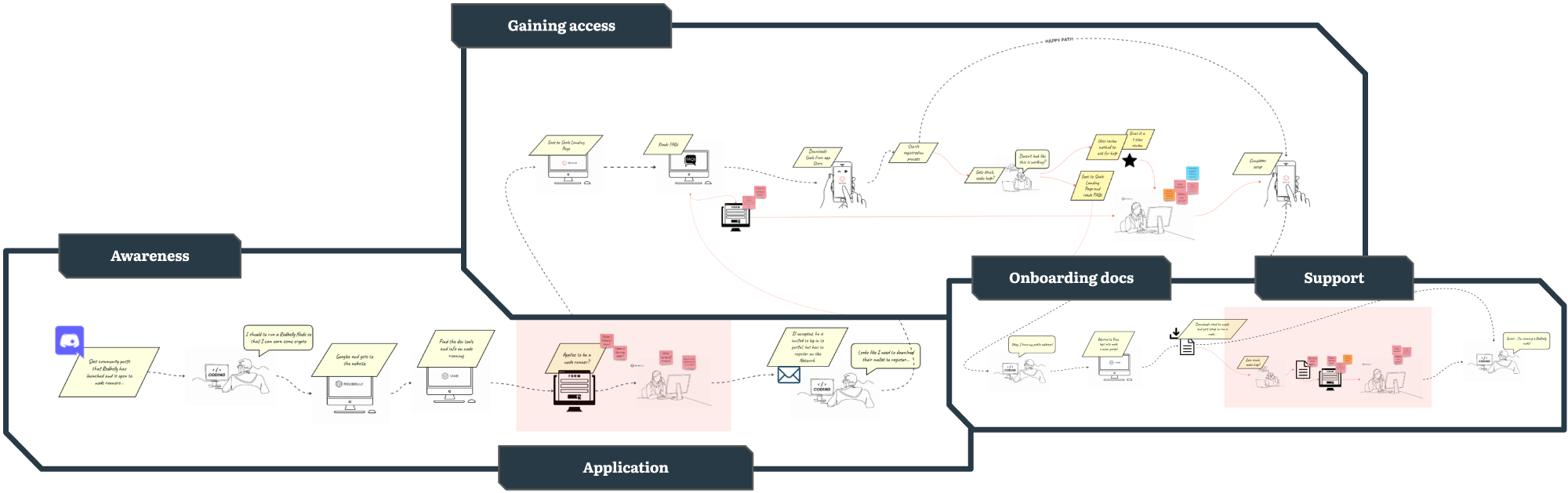

To imagine the ideal service and highlight gaps in existing plans, the process started with high-level storyboarding.

A high level storyboard detailing the basic use-case developer journey from end-to-end.

A high level storyboard detailing the basic use-case developer journey from end-to-end.

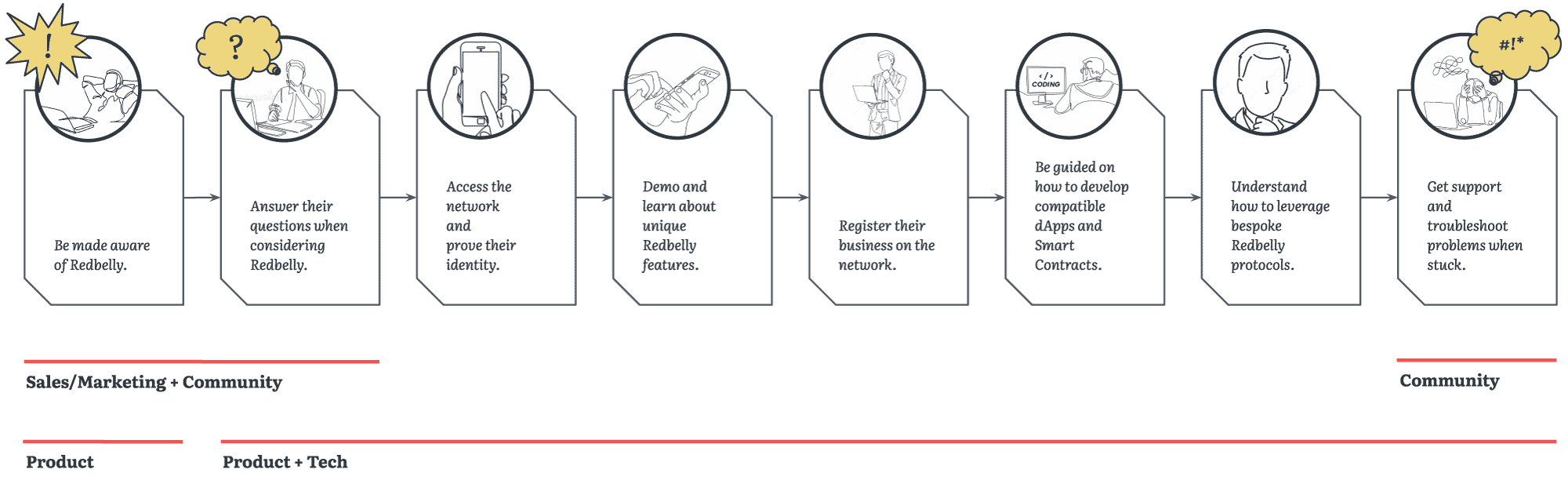

This process identified that an end-to-end flow would need to provid a way for use-case developers to:

- Be made aware of Redbelly

- Answer relevant questions when considering Redbelly.

- Access the network and prove their identity.

- Demo and learn about unique Redbelly features.

- Register their business on the network.

- Be guided on how to develop compatible dApps and Smart Contracts.

- Understand how to leverage bespoke Redbelly protocols.

- Get support and troubleshoot problems when stuck.

These needs mapped to organisation collaboration requirements.

Steps required for developer success, and their link to organisational divisions.

Steps required for developer success, and their link to organisational divisions.

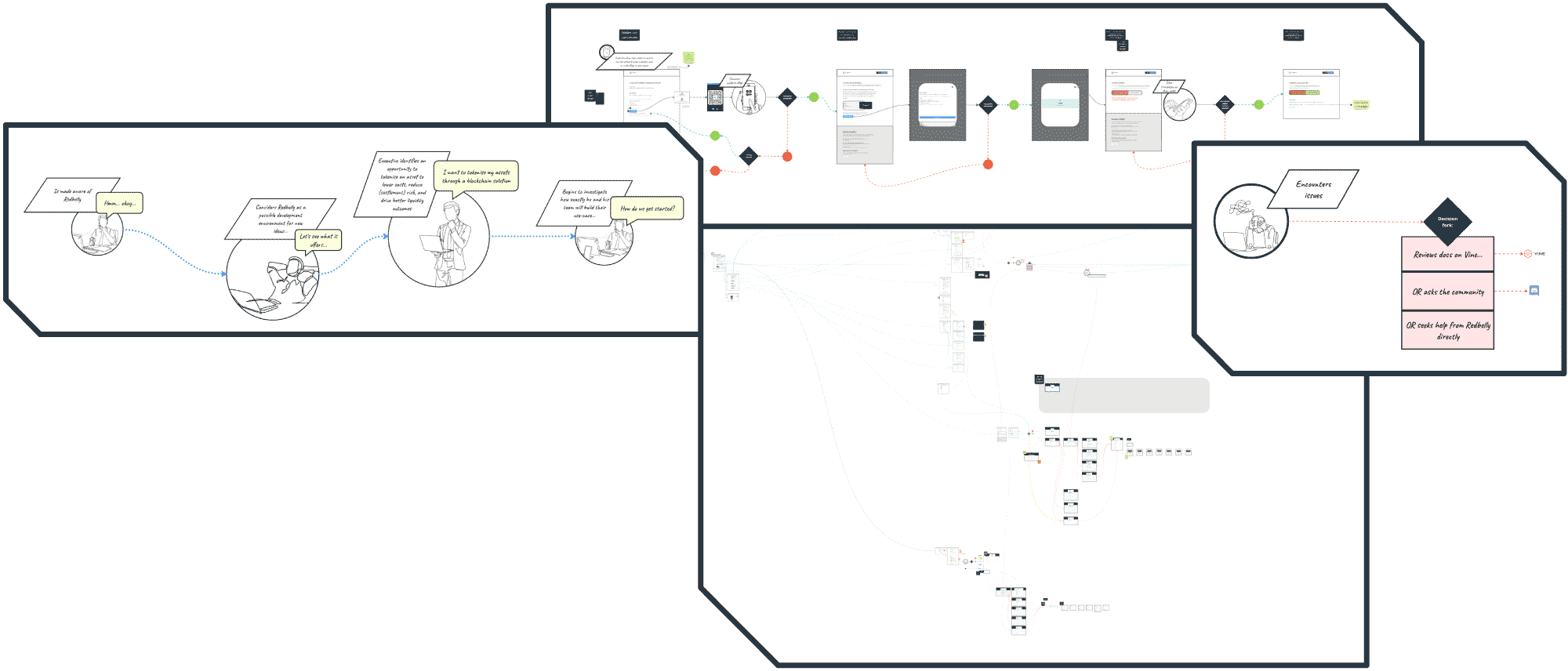

Detailed design of the journey across touchpoints

The varoius touch-points and content, along with the sequence across them was designed considering both happy and sad paths with the following decision-making principles employed:

- One thing at a time: Offer introductions and start things with a step-by-step overview or guide.

- Seperate concerns: Keep things sharp and short, for example each page should have 1 purpose, 1 message and 1 clear action.

- Connect things to the real-world: Translate web3 lingo into common terms.

UX flow design for use-case developer end-to-end journey.

UX flow design for use-case developer end-to-end journey.

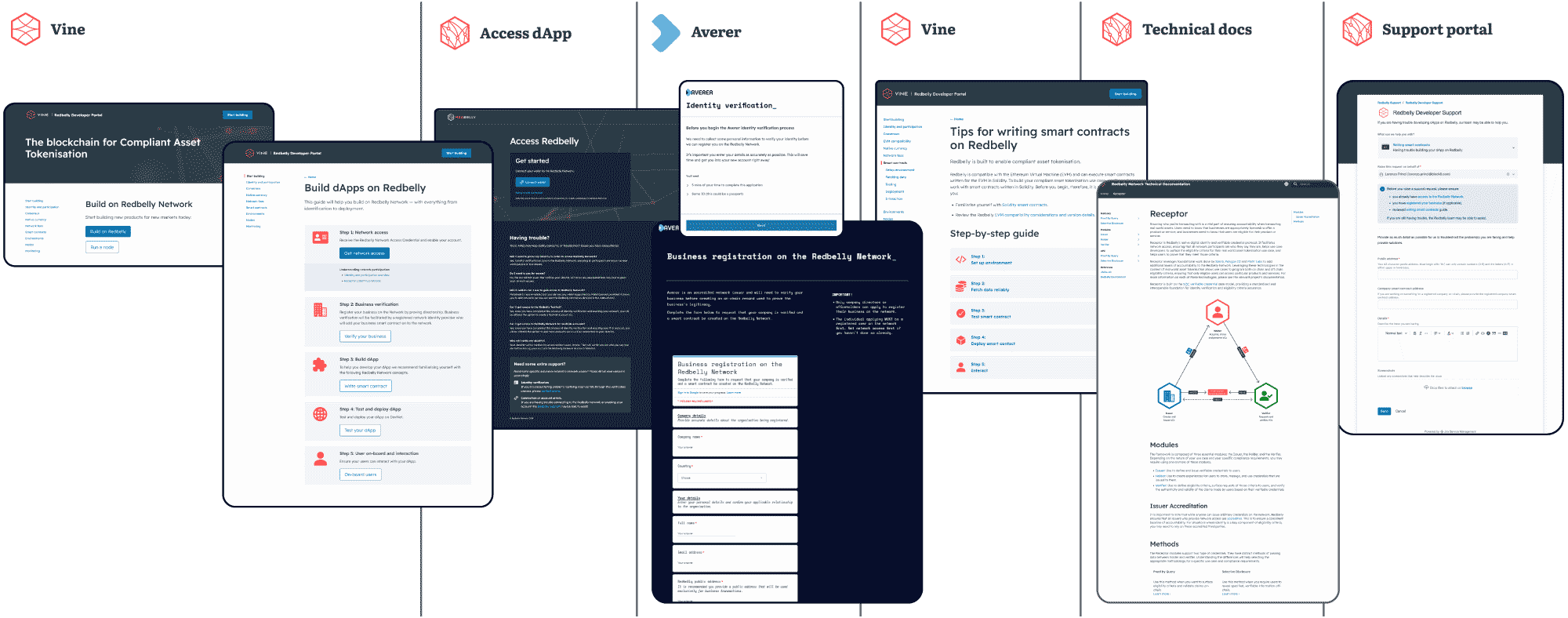

Branding the touch-points

Once the user experience flow was defined, the Redbelly design principles and design system were applied to the various web2 and web3 touch-points which facilitate the experience. This branding exercise ensured cohesion both visually, and in tone-of-voice.

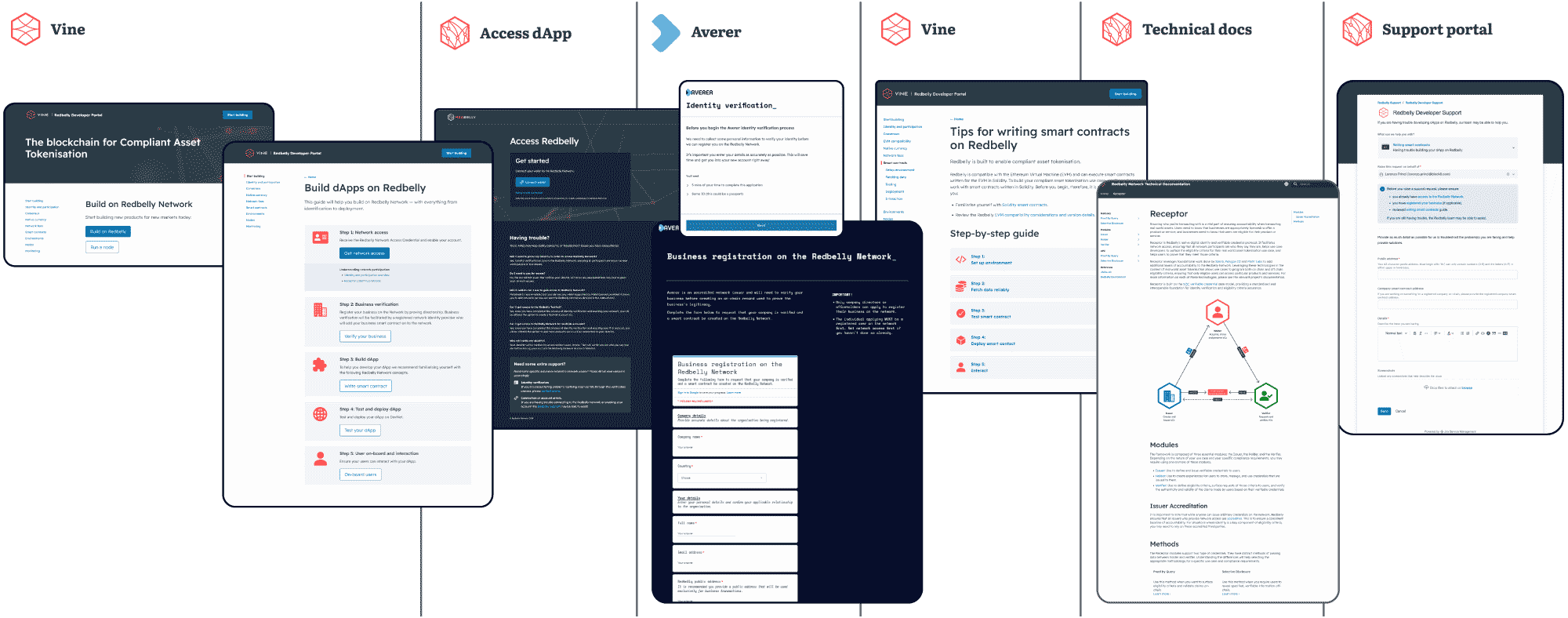

Snapshot of each web2 and web3 touch-point required for the journey.

Snapshot of each web2 and web3 touch-point required for the journey.

From left to right:

Vine

The Redbelly Developer Portal was the starting point, and the main landing from communication call-to-actions. It would be a central hub providing guidance for building on the infrustructure.

Access dApp

A web3 decentralised app which enables users to connect the wallet and gain network access.

Averer

A subsidiay brand created to facilitate the identity verification process at launch. It also served to showcase how identity providers were a distributed concept. The plan to expand this marketplace was deferred to after the launch.

Receptor

The native identity protocol which dictates the accountability policies on-chain.

Redbelly Technical Docs

Rich technical documentation for network protocols.

Redbelly Support Portal

Facilitated through Jira Service Desk, the portal allowed for use-case developers to submit troubleshooting requests as a last resort.

High fidelity touch-point flow

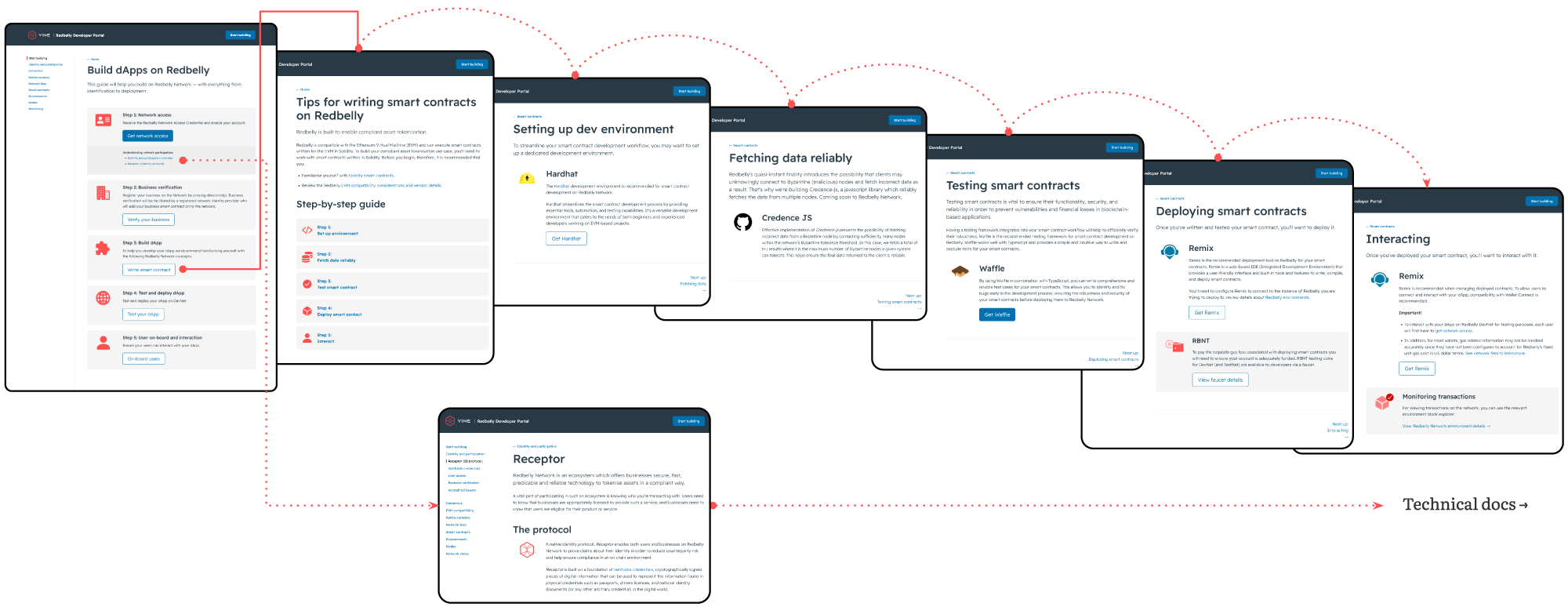

The following examples show how the end-to-end journey for developers was supported, including introducing the network, gaining access, guidance on building and deploying their smart contracts and dApps, and how to reach out for support.

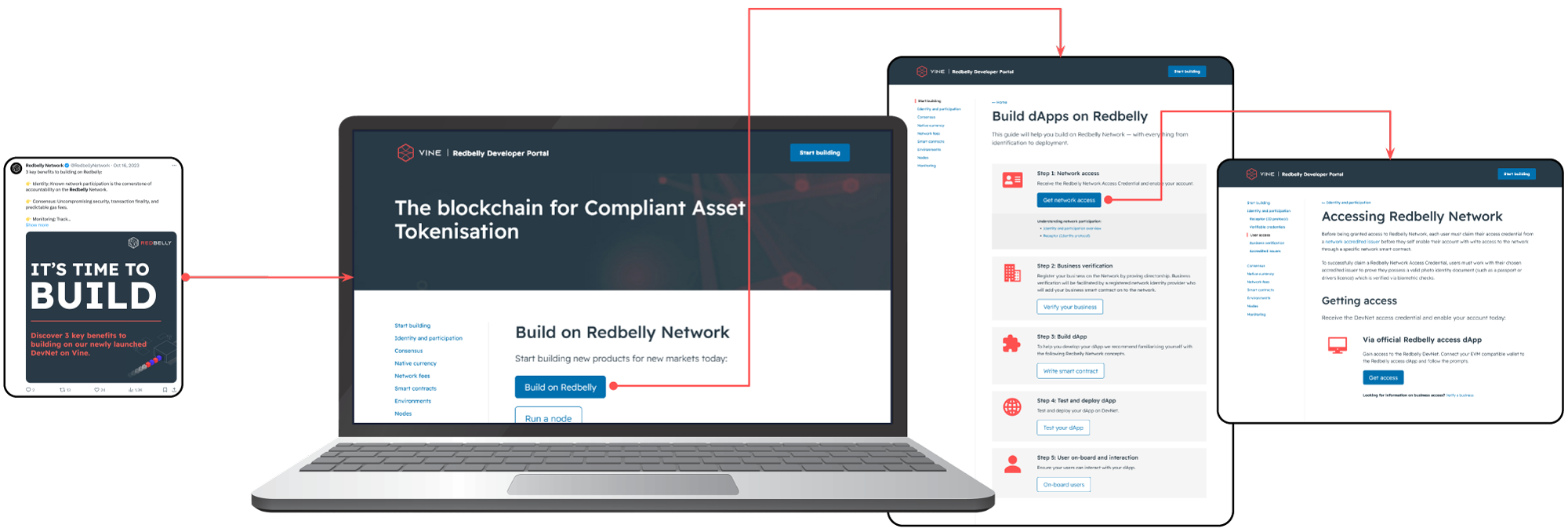

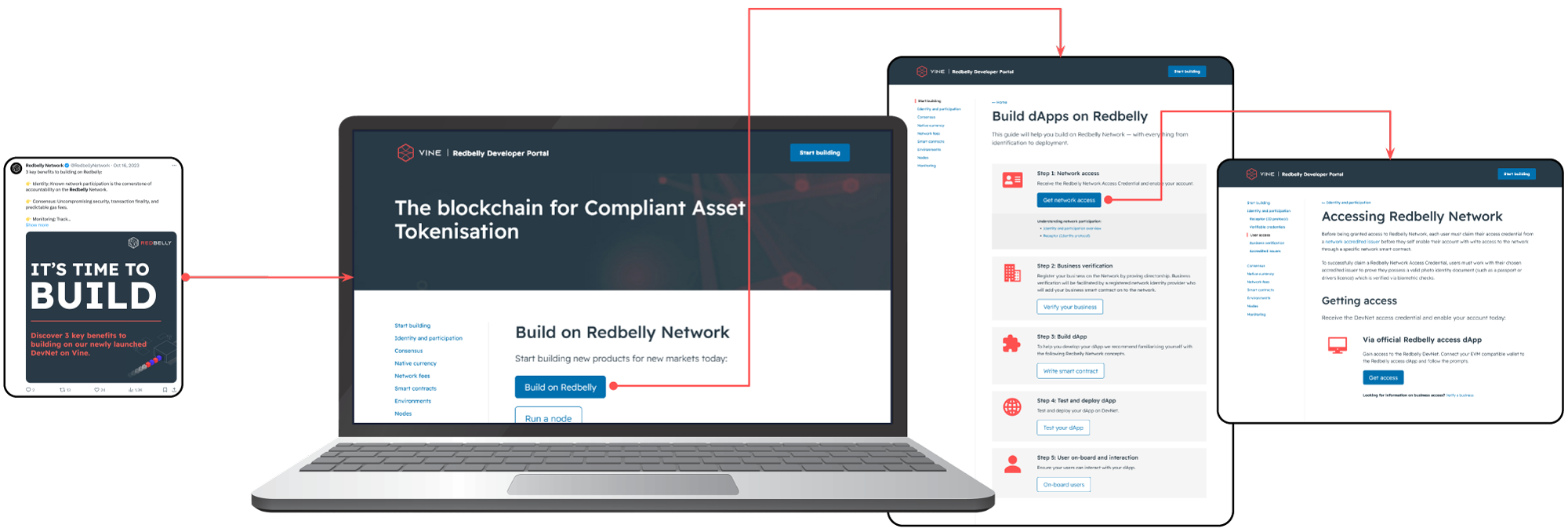

1/ Getting developers started

The journey starts at social post or other commercial touch-point and directs to Vine which provides a starting point depending on the users goals, such as a step-by-step dApp development guide.

Getting started flow on Vine.

Getting started flow on Vine.

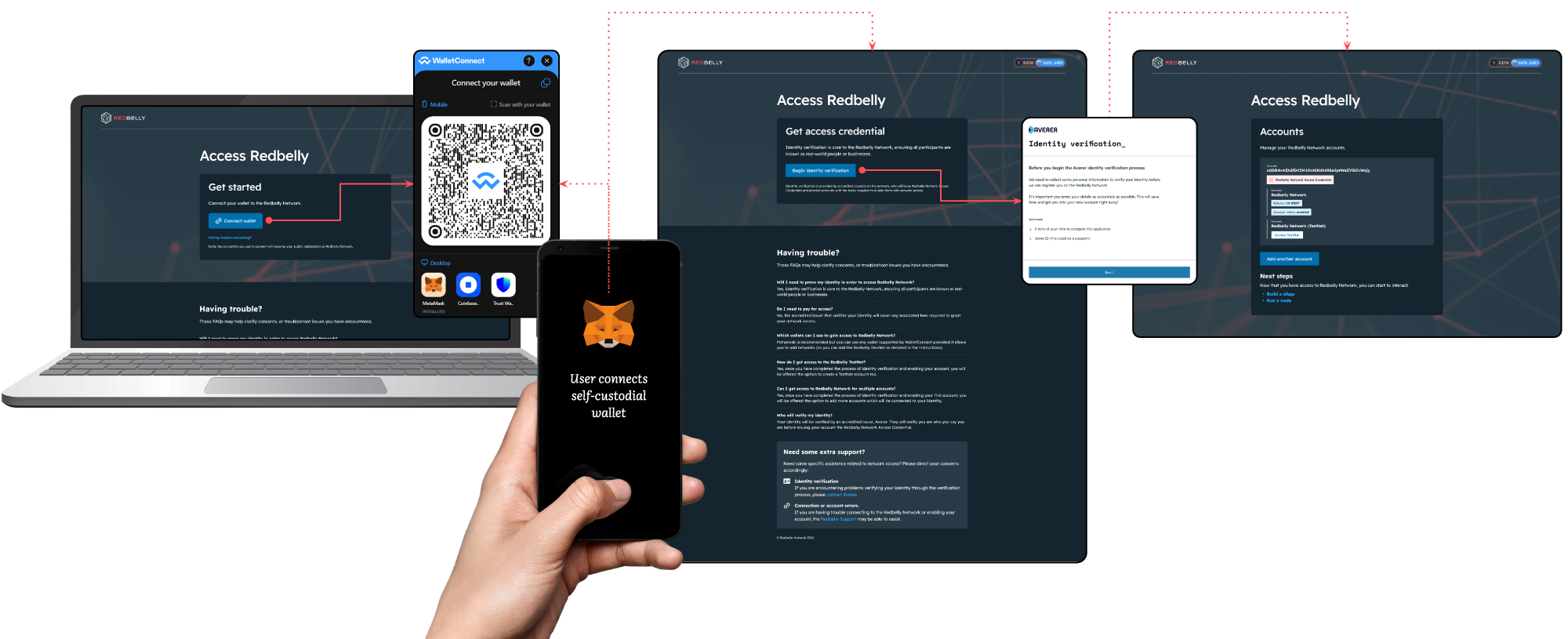

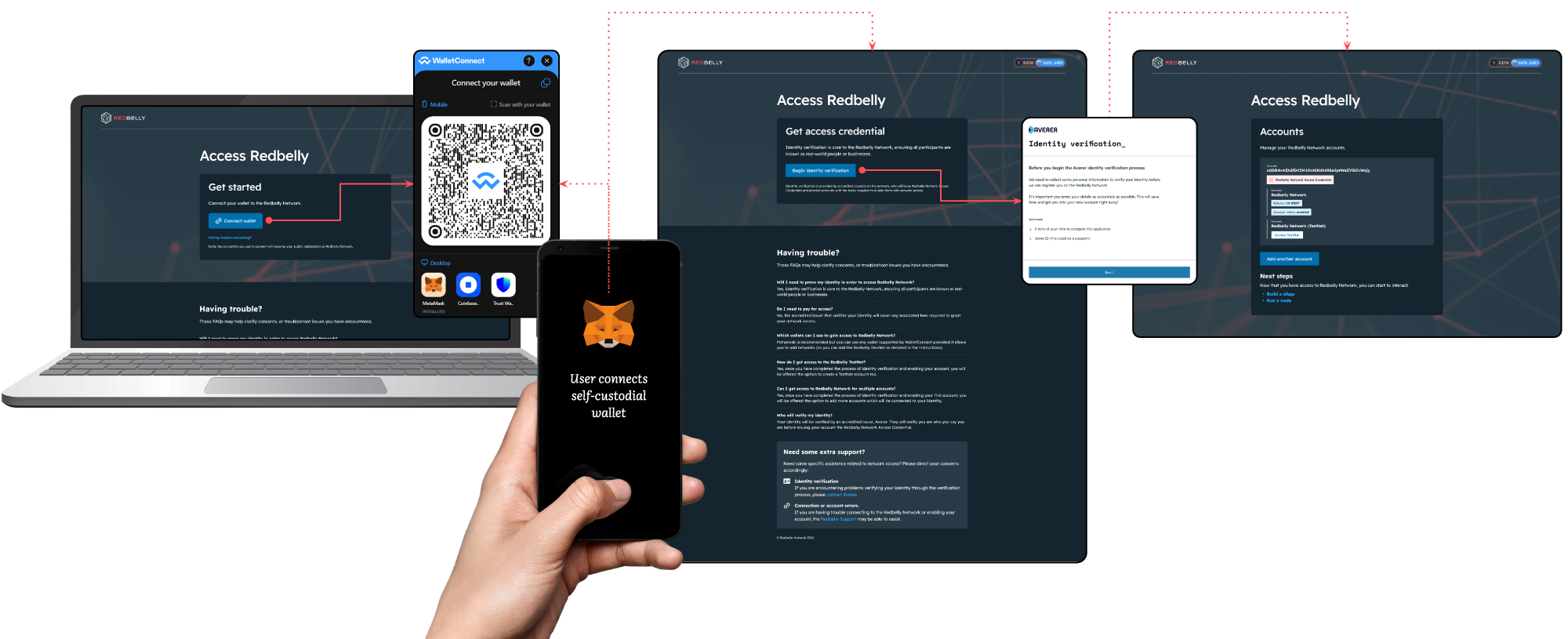

2/ Gaining access to the network

The official Redbelly access dApp Provides access to network via walletconnet to expand wallet compatibility pool.

Access dApp flow for connecting and registering on Redbelly.

Access dApp flow for connecting and registering on Redbelly.

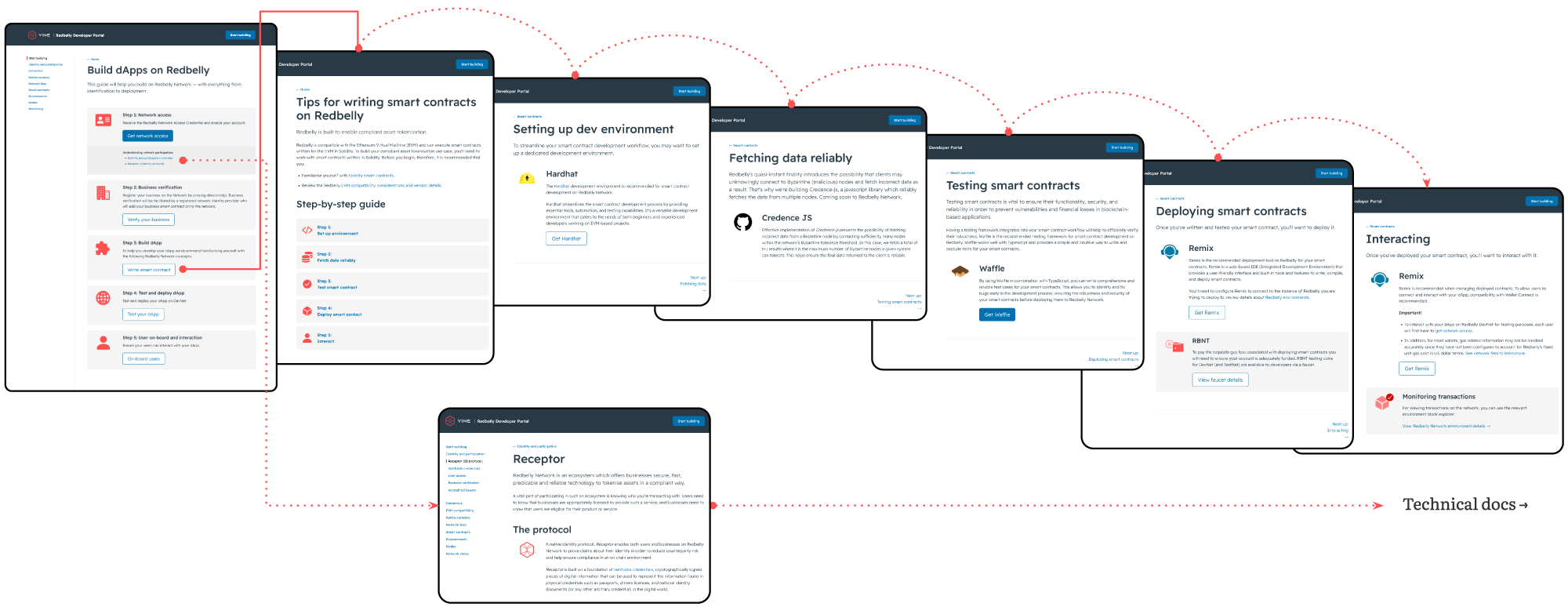

3/ Guidance on developing an app on Redbelly

Step-by-step guidance and recommended practices for developing on Redbelly.

Guidance of each step of delivering a smart contact.

Guidance of each step of delivering a smart contact.

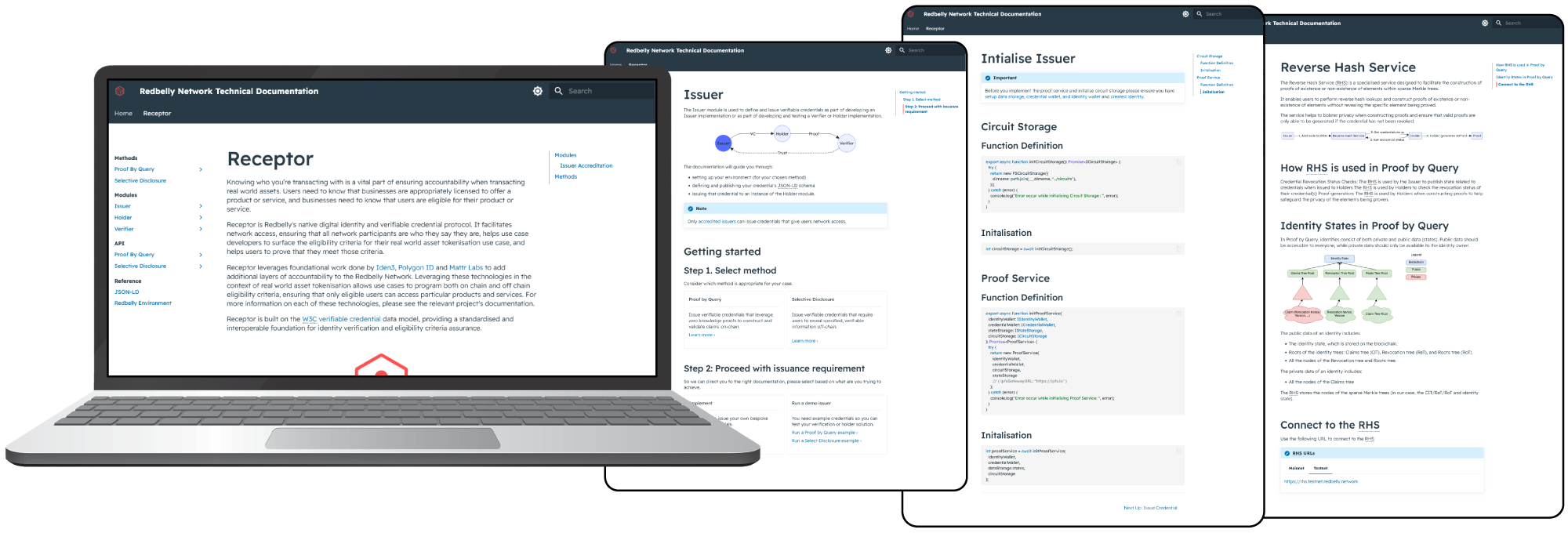

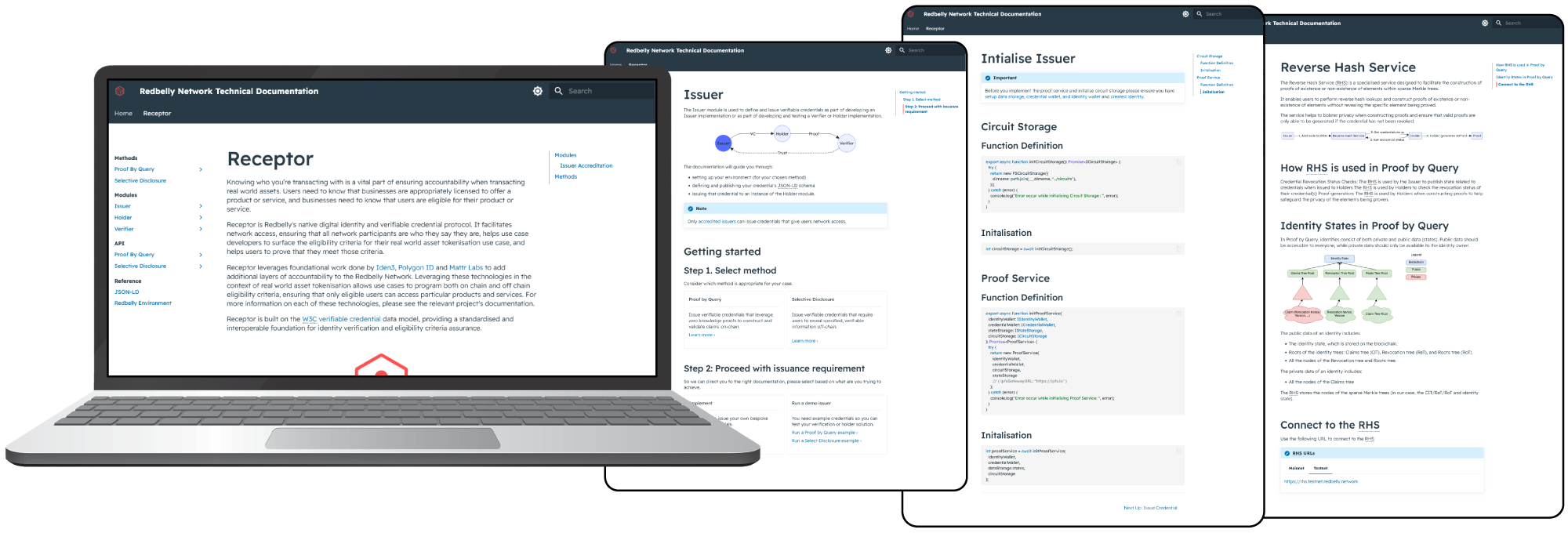

4/ Technical docs for the Receptor protocol

Deeper guidance on technical implementation for Redbelly specific protocols for those who want to add eligibility criteria to their smart contract.

Technical documentation for the Receptor protocol.

Technical documentation for the Receptor protocol.

5/ Getting support

Support flow from Vine to Jira service desk ensures users are provided with guidance to resolve technical issues before raising direct support with the Redbelly team.

Redbelly support flow prompts users with alternatives before a request can be submitted.

Redbelly support flow prompts users with alternatives before a request can be submitted.

Mesuring success

Early adopters were provided with DevNet access before the launch of the network, along with the Vine as a starting point. In great numbers were they able to deploy and run the test applications, helping to highlight some technical issues along the way along and offered feedback which helped amend the documentation. The support flow was seldom used, and limited to actual bugs.

3rd largest TVL project across popular chains, according to DefiLlama (as of 15/12/2024).

3rd largest TVL project across popular chains, according to DefiLlama (as of 15/12/2024).

The tokenisation process involves detailing the ownership rights and obligations of assets in a digital smart contract, deployed on a blockchain.

The tokenisation process involves detailing the ownership rights and obligations of assets in a digital smart contract, deployed on a blockchain.

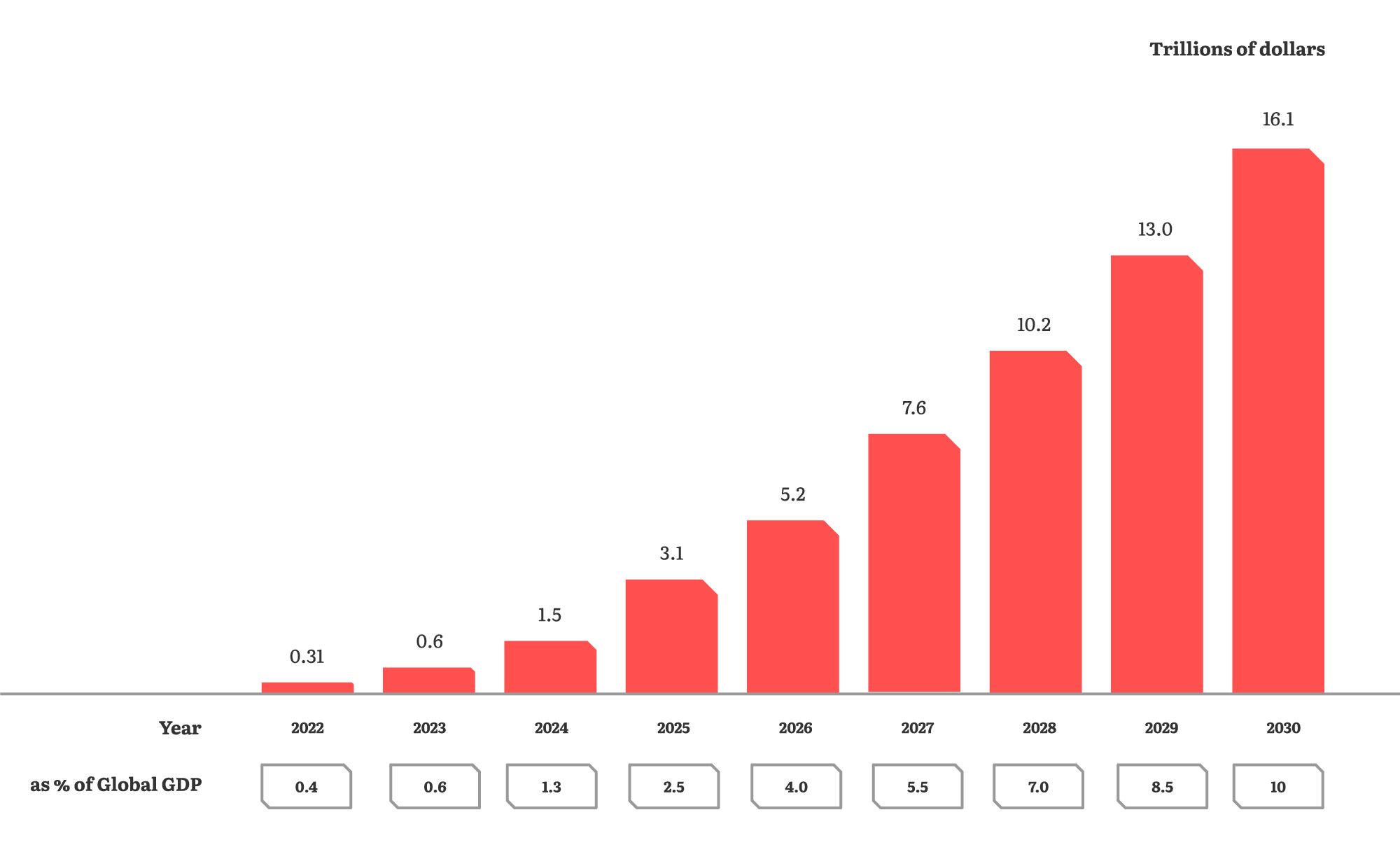

The predicted trajectory of real-world tokenisation value by Cointelegraph.

The predicted trajectory of real-world tokenisation value by Cointelegraph.

Collage of some of some studies reviewed and interviews conducted.

Collage of some of some studies reviewed and interviews conducted.

Steps being taken in the short term vs longer-term for asset tokenisation issuers.

Steps being taken in the short term vs longer-term for asset tokenisation issuers.

A high level storyboard detailing the basic use-case developer journey from end-to-end.

A high level storyboard detailing the basic use-case developer journey from end-to-end.

Steps required for developer success, and their link to organisational divisions.

Steps required for developer success, and their link to organisational divisions.

UX flow design for use-case developer end-to-end journey.

UX flow design for use-case developer end-to-end journey.

Snapshot of each web2 and web3 touch-point required for the journey.

Snapshot of each web2 and web3 touch-point required for the journey.

Getting started flow on Vine.

Getting started flow on Vine.

Access dApp flow for connecting and registering on Redbelly.

Access dApp flow for connecting and registering on Redbelly.

Guidance of each step of delivering a smart contact.

Guidance of each step of delivering a smart contact.

Technical documentation for the Receptor protocol.

Technical documentation for the Receptor protocol.

Redbelly support flow prompts users with alternatives before a request can be submitted.

Redbelly support flow prompts users with alternatives before a request can be submitted.

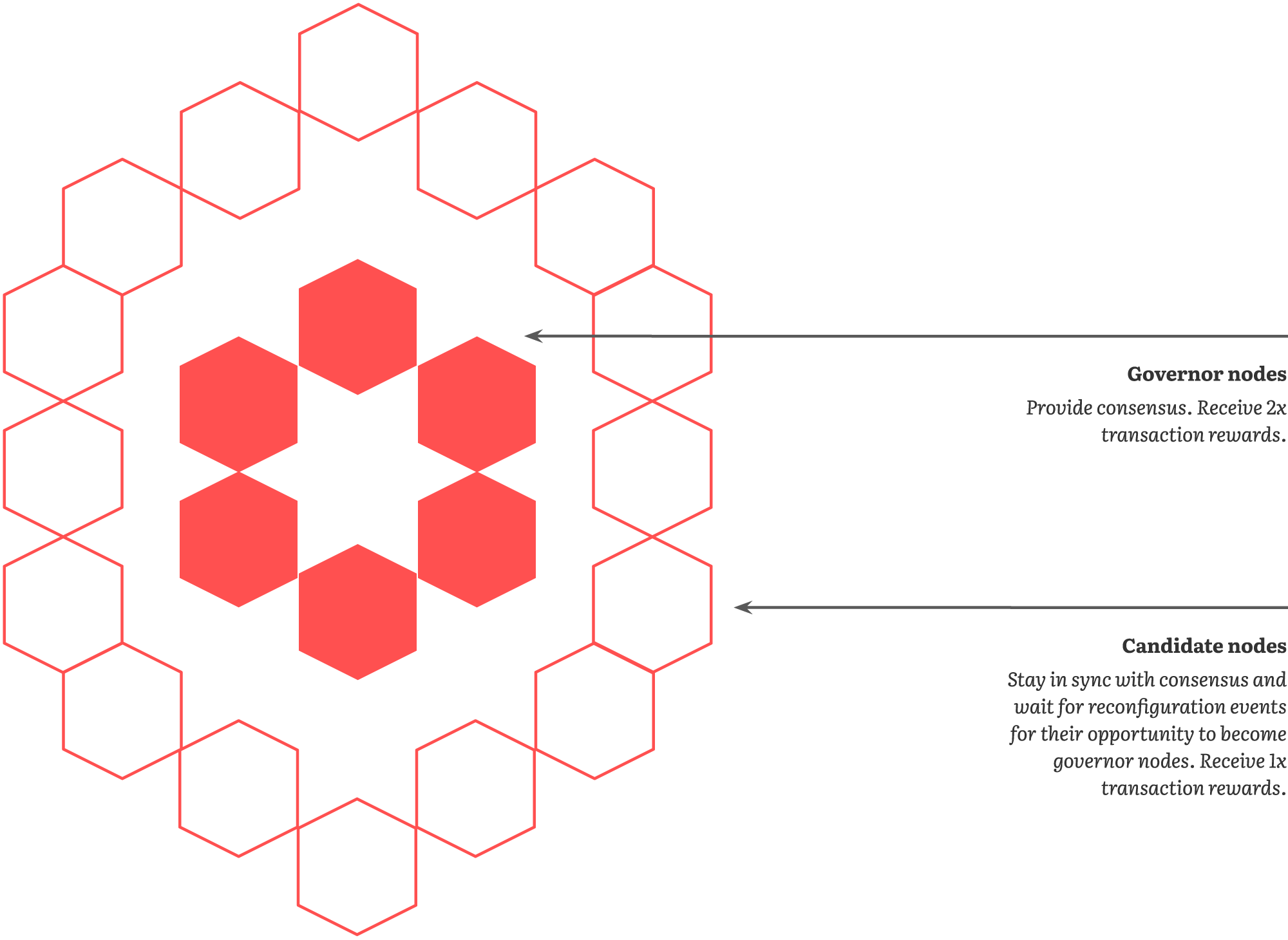

Redbelly nodes are either governer nodes, that run the concensus, or candidate nodes, who remain in sync until the new reconfiguration event. Each get a share of the transaction fees so long as they meet their commitments.

Redbelly nodes are either governer nodes, that run the concensus, or candidate nodes, who remain in sync until the new reconfiguration event. Each get a share of the transaction fees so long as they meet their commitments.

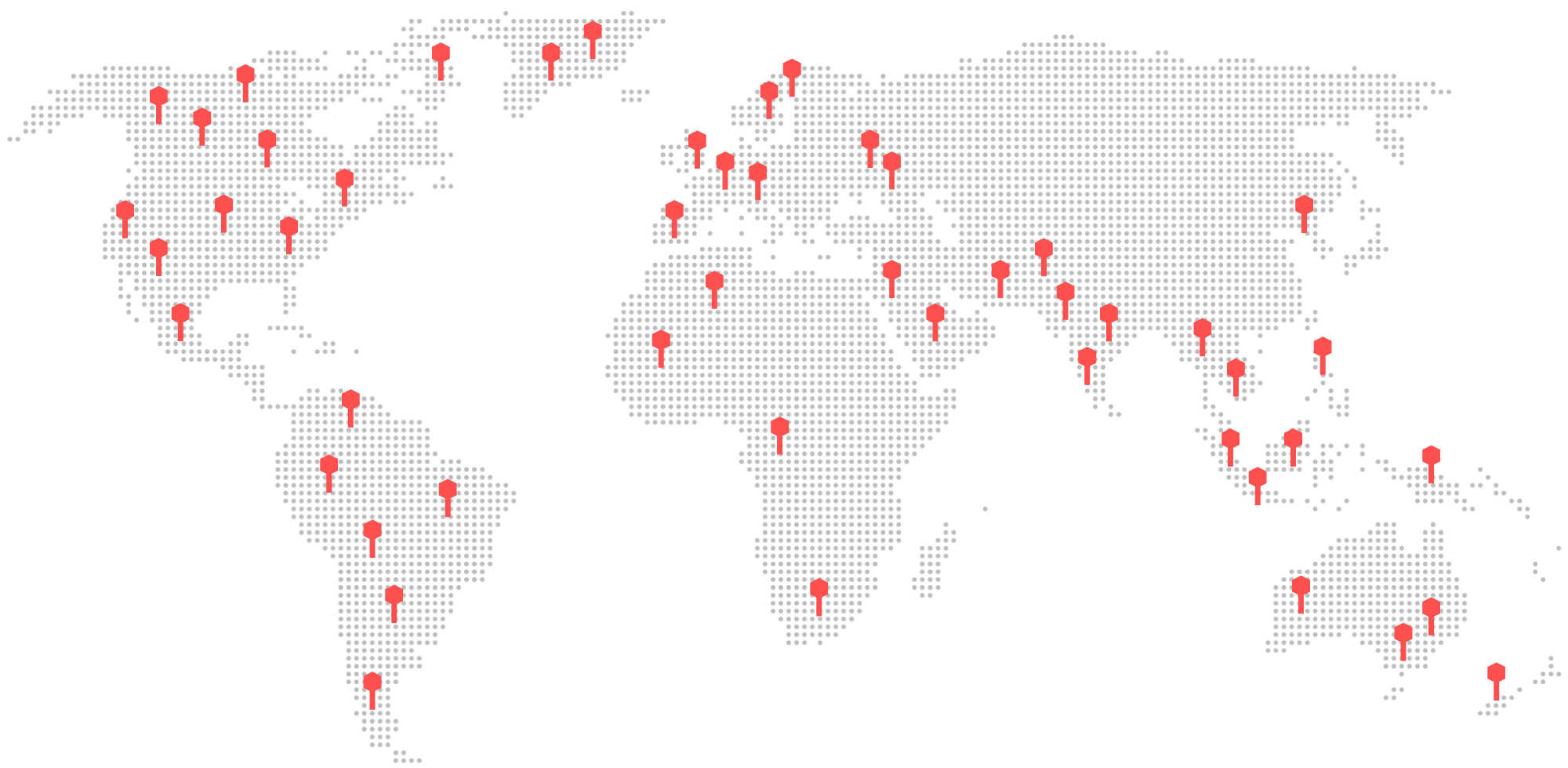

A map indicting the ideal global distribution of network governors.

A map indicting the ideal global distribution of network governors.

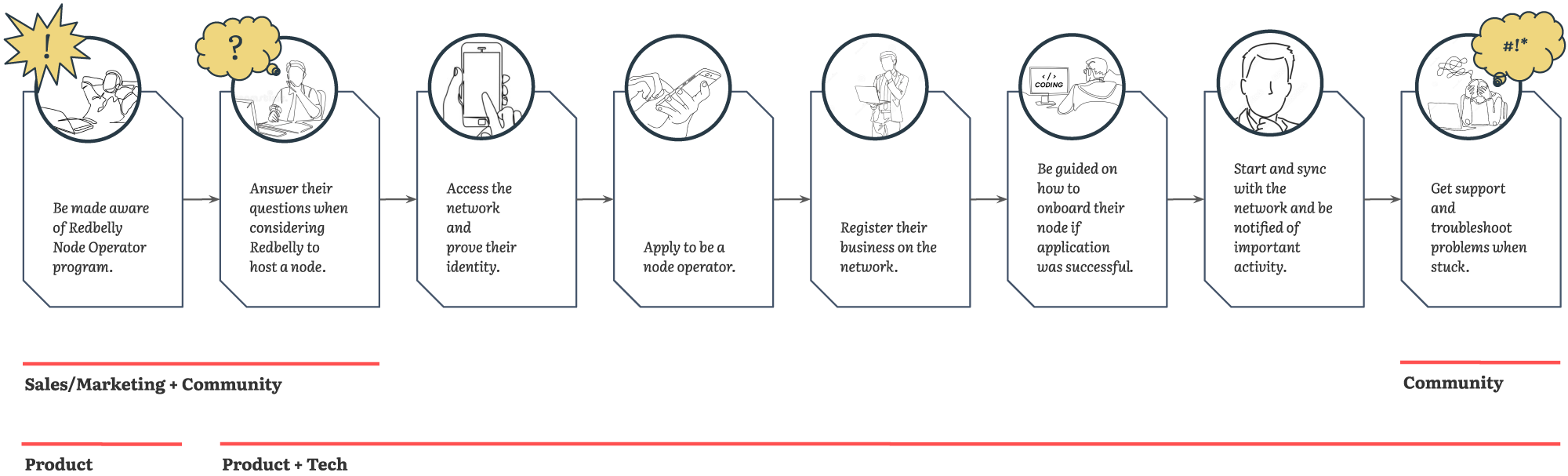

A high level storyboard detailing the basic node operator journey from end-to-end.

A high level storyboard detailing the basic node operator journey from end-to-end.

Steps required for node operator success, and their link to organisational divisions.

Steps required for node operator success, and their link to organisational divisions.

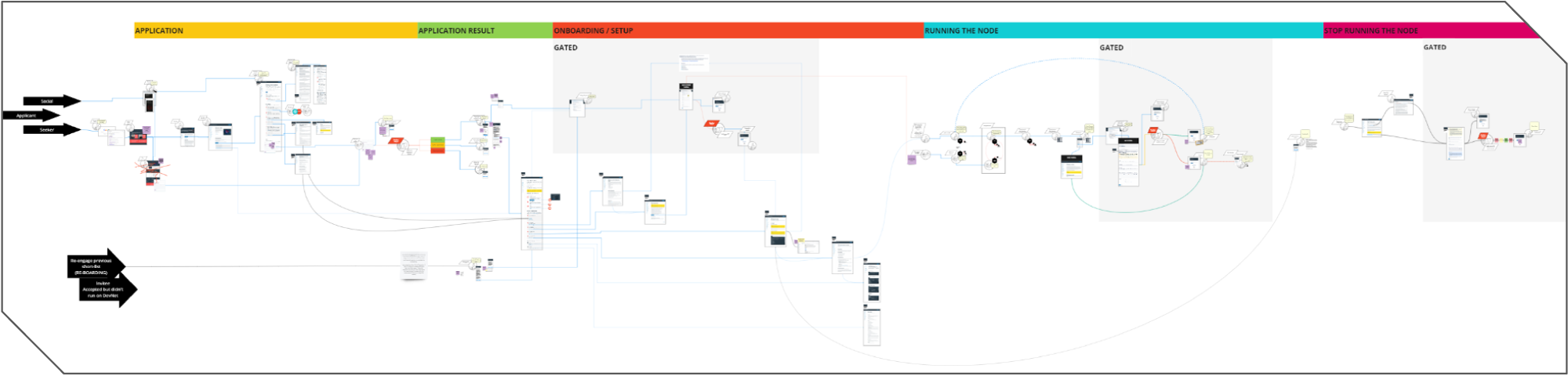

UX flow design for node operator end-to-end journey.

UX flow design for node operator end-to-end journey.

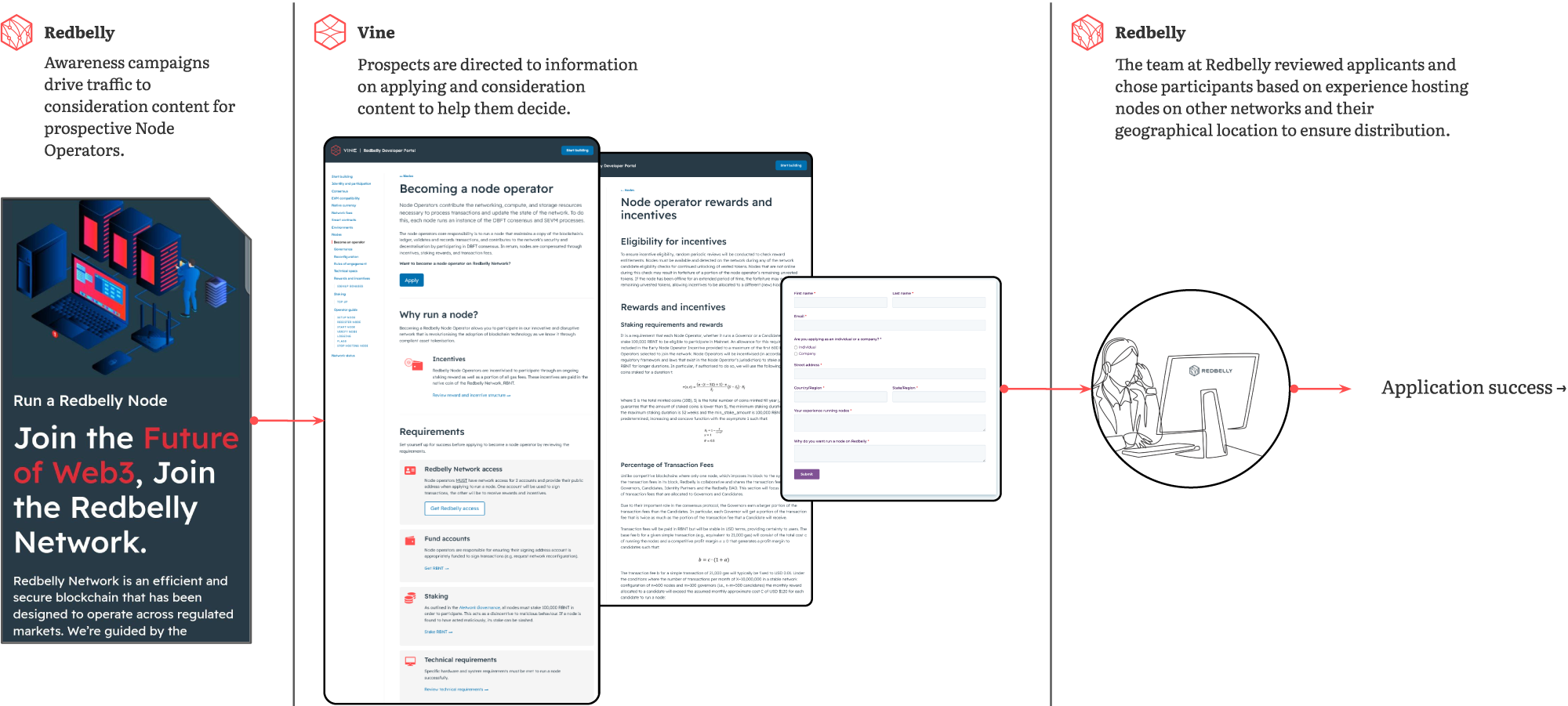

Redbelly Node Operator application process.

Redbelly Node Operator application process.

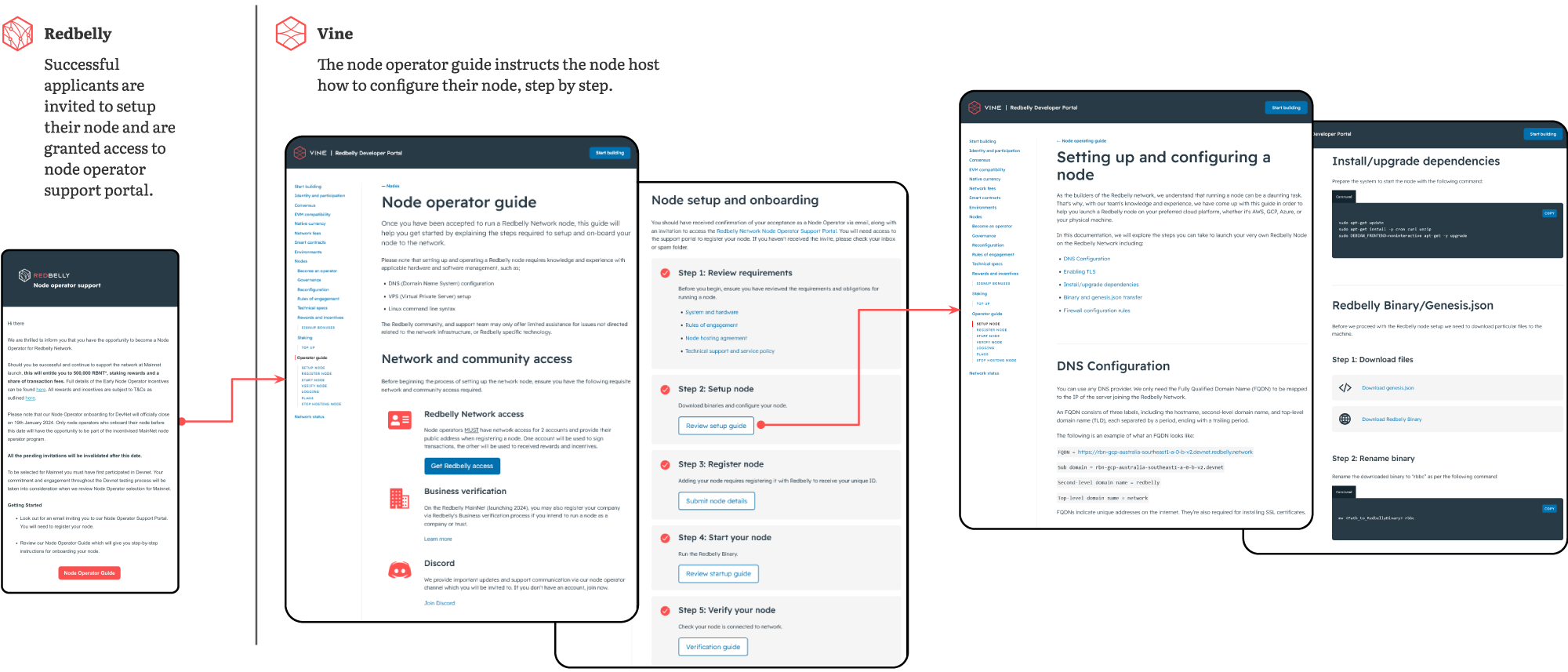

Node operator onboarding guidance.

Node operator onboarding guidance.

Node operator registration flow.

Node operator registration flow.

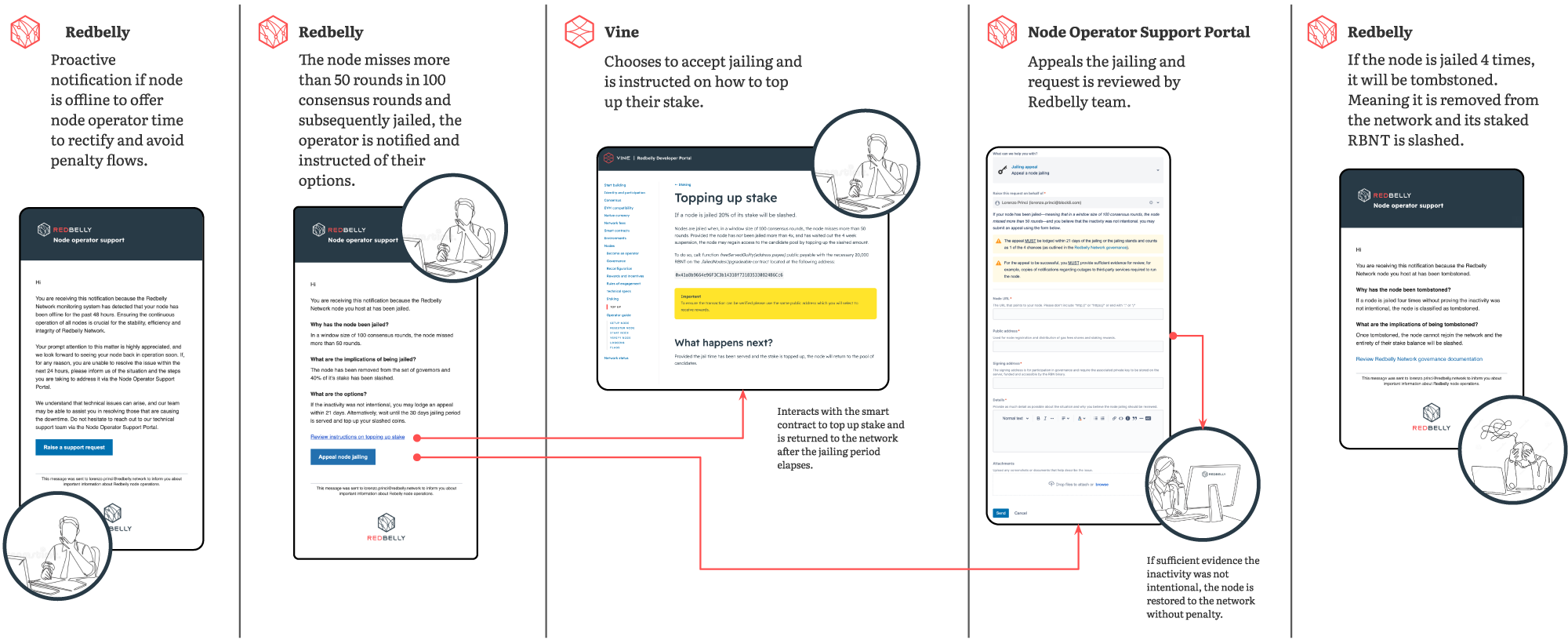

Node operator running and policy notification flow.

Node operator running and policy notification flow.